This is the first in a series of articles about financial exploitation of older adults related to the coronavirus pandemic. Learn more about elder justice.

The coronavirus pandemic sweeping the world since early 2020 has claimed more than 500,000 lives in the United States, infected millions more in the country, and has transformed the way hundreds of millions of Americans work and live. Among the segments of society that have suffered impacts disproportionate to their share of the population are older adults.

One pandemic-related impact on older adults is the increased financial exploitation undertaken by fraudsters since the public health emergency took hold in March 2020. The heightened physical isolation of these victims resulting from government-mandated restrictions and voluntary social distancing have emboldened bad actors seeking to take advantage of the victims’ reliance on the online medium to maintain contact with the world. Governments and the public at large should focus attention on this increase in elder exploitation.

Effectively responding to this ongoing challenge requires a data-driven approach that seeks to assess the most widespread elder exploitation threats and those that result in the greatest financial losses.

Making Contact

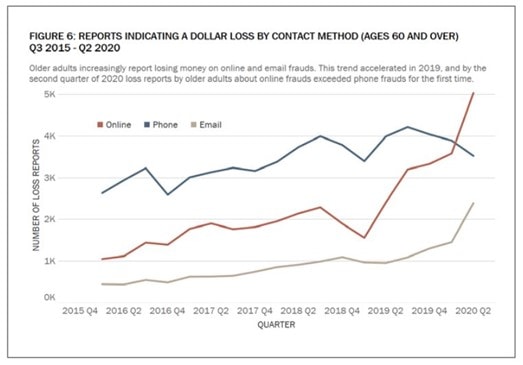

According to Federal Trade Commission (FTC) data, since 2019, the monetary losses Americans 60 and older have reported from fraud facilitated by first contact made online sharply increased in the first two quarters of 2020, surpassing similar reports associated with phone-based scams. This period coincided with the shuttering of schools, businesses, indoor recreational spaces, and various other spheres of daily life as the coronavirus spread throughout the United States.

Image Source: Federal Trade Commission1

While online contact was the leading means overall of targeting older adults for scams, the online contact phenomenon was more prevalent in the 60-69 age range.2 In 2020, for those 70 and older, initial phone contact was still the more frequently reported means of contact by swindlers targeting older adults.3

Aggregate Losses

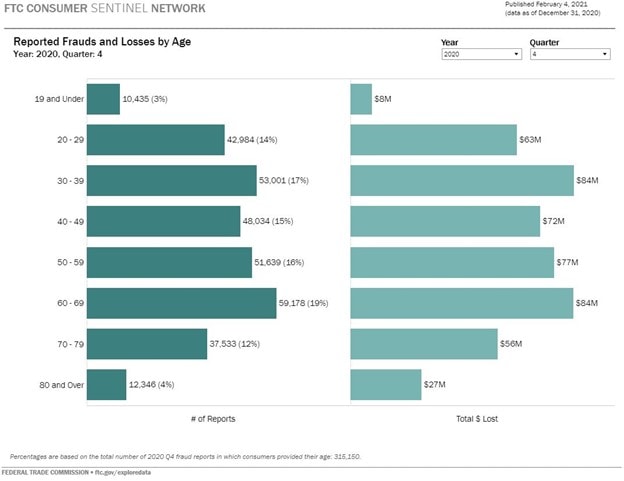

Examining FTC data for the fourth quarter (Q4) of 2020, the older adult age group suffering the greatest loss was 60-69, with a total reported loss of $84 million. Those aged 70-79 followed with $56 million, and those 80 and over lost $27 million.4, 5

Image Source: Federal Trade Commission4

Median Individual Losses

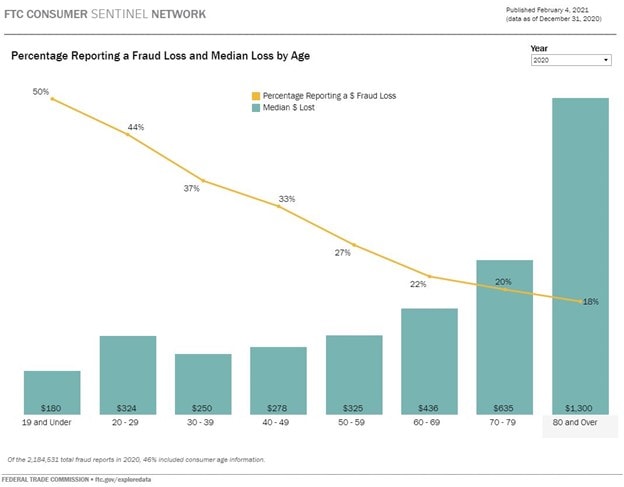

2020 full-year FTC data of total losses shows that, although a greater percentage of younger age groups had fraud loss reports, the reported median fraud loss amounts for older adults were much higher per person. Age groups 19 and under, 20-29, and 30-39 had a range of median reported losses of $180 to $250 per person, while age groups 60 and older had a range of $436 to $1,300, highlighting how fraud in the pandemic era has continued to inflict greater individual costs on older adults, as it has in years past.

Image Source: Federal Trade Commission6

Methods of Financial Elder Exploitation

Understanding the methods by which older adults are financially exploited is a key piece of the analytical puzzle when prioritizing resources to combat fraud against this vulnerable population group.

FTC data from Q4 2020 reveals romance scams as the fraud subcategory that had the highest overall reported losses at $43.81 million for age groups starting at 60, a staggering sum for only a three-month period.7 This amount represents an increase of 67.34% from $26.18 million reported lost to romance scams in Q4 2019 before the pandemic.3 Government imposter scams, business imposter scams, and prizes, sweepstakes, and lotteries scams were distant but still substantial Top 3 sources of financial loss for older adults in Q4 2020.8 Below is a distillation of FTC data on the top three reported fraud subcategories by total loss in Q4 2020, arranged by age group. It also shows the percentage change in losses from Q4 2019.

| Age Group | Top 3 Fraud Subcategories by Total $ Loss (Q4 2020) | Total $ Loss (Q4 2019) | Total $ Loss (Q4 2020) | % Change from Q4 2019 in Total $ Loss (Rounded to Nearest %) |

|---|---|---|---|---|

| 60-69 | 1. Romance Scams 2. Government Imposters 3. Business Imposters | $16.41 million $5.45 million $4.96 million | $27.58 million $9.38 million $8.96 million | 68%+ 72%+ 81%+ |

| 70-79 | 1. Romance Scams 2. Business Imposters 3. Government Imposters | $9.31 million $3.07 million $6.02 million | $12.57 million $8.65 million $6.93 million | 35%+ 182%+ 15%+ |

| 80 and over | 1. Prizes, Sweepstakes, and Lotteries 2. Romance Scams 3. Business Imposters | $5.19 million $0.46 million $1.09 million | $7.02 million $3.66 million $3.02 million | 35%+ 696%+ 177%+ |

| Data Source: Federal Trade Commission9 | ||||

A caveat to the data above is that higher total loss amounts in a subcategory of fraud do not necessarily correlate with larger numbers of older adults being affected. For example, while romance scams cost older adults 60-69 a reported $27.58 million in Q4 2020, this amount was based on 1,002 reports compared to 11,509 business imposter scams reported in the same period. Business imposter scams resulted in less than one-third of the total loss amount attributed to romance scams for this age group.3 This is due to the difference in the median individual loss for these two fraud subcategories. In Q4 2020, older adults 60-69 reported a median individual loss of $4,400 per person as a result of romance scams while they reported a median individual loss of $1,000 as result of business scams.3 This reality underscores the pronounced destructiveness of romance scams: while affecting far fewer older adults, they have a markedly more devastating financial impact, potentially leading to impoverishment of victims and associated harmful outcomes like depression and loss of housing.

Conclusion

Some fundamental takeaways for governmental authorities and the public to consider based on this data:

- More attention should be focused on outreach efforts to older adults by all levels of government, particularly state and local governments, to educate them about the dangers of increased online interactions while they shelter from the pandemic.

- 80 and over, the most advanced age group and the one with the highest levels of cognitive decline, should not be overlooked despite comparatively lower total financial losses, as they tend to be softer targets for fraud and lose higher amounts per person than the other older adult age groups.

- Prioritization of governmental and civic resources is essential to counter romance scams when loneliness for many older adults has become more acute during the pandemic, when their physical isolation has made them more susceptible to the schemes of confidence tricksters, particularly online.

As with any endeavor, the approach to protecting the nation’s aging citizens should be driven by data to best allocate finite human and material assets to have maximum impact in this area. Governmental authorities (particularly at the state and local levels), civic groups, and the public at large can use this data to craft policy, enforce the law, and educate older adults and their caregivers to guard against the perils of financial exploitation in the midst of a global pandemic.

- Protecting Older Consumers: A Report of the Federal Trade Commission to Congress, at 11 (October 18, 2020) [↩]

- https://public.tableau.com/views/AgeandFraud/Infographic [↩]

- Id. [↩][↩][↩][↩]

- https://public.tableau.com/views/FraudReports/AgeFraud [↩][↩]

- The age group 30-39 also suffered $84 million in reported losses; however, the total general population of 30-39 is larger than that of 60-69 by several million people, meaning that the fraud took a heavier toll on the comparatively smaller 60-69 age group. [↩]

- https://public.tableau.com/views/FraudReports/AgeFraudLosses [↩]

- https://public.tableau.com/views/FraudReports/AgeDetails [↩]

- For FTC definitions of these subcategories, see Consumer Sentinel Network Subcategory Definitions (January 2021). https://www.ftc.gov/system/files/attachments/data-sets/csn_psc_full_descriptions12621.pdf. [↩]

- https://public.tableau.com/views/FraudReports/AgeDetails [↩]