Protecting people from scams is a challenging mission even without the overlay of a global pandemic. But as the past 18 months have demonstrated, con artists view every breaking news story about COVID-19 as an opportunity for a new fraud or flimflam. Consumer protection agencies – including the Federal Trade Commission and state attorneys general – have responded to the crisis by adopting creative methods to combat bogus health claims, phony financial representations, and other forms of fraud that threaten public health and personal finance.

Protecting people from scams is a challenging mission even without the overlay of a global pandemic. But as the past 18 months have demonstrated, con artists view every breaking news story about COVID-19 as an opportunity for a new fraud or flimflam. Consumer protection agencies – including the Federal Trade Commission and state attorneys general – have responded to the crisis by adopting creative methods to combat bogus health claims, phony financial representations, and other forms of fraud that threaten public health and personal finance.

Even as the battle against the virus continues, let’s consider six lessons the FTC staff has learned so far that will impact our work going forward.

Alert consumers early.

On February 3, 2020, the United States declared the coronavirus outbreak to be a public health emergency. Just a week later, on February 10, 2020, the FTC issued its first alert to consumers, Coronavirus: Scammers follow the headlines. Sent to hundreds of thousands of FTC blog subscribers and picked up in national media, the post warned people about phishing emails falsely claiming to come from the CDC, unproven claims of “medical breakthroughs,” shady outfits masquerading as charities, and other COVID-related scams that were already emerging. State attorneys general also moved quickly to alert consumers about what con artists were up to.

In the early days of the pandemic – a time when many courthouses were struggling to stay open – the FTC and state attorneys general stepped up COVID-related law enforcement investigations while pursuing on a parallel track educational campaigns to empower consumers against scams. Of course, warnings and alerts aren’t a substitute for law enforcement, but they can play a key supplemental role by preventing defendants and copycat violators from inflicting even more injury on consumers as cases make their way through the courts. What’s more, those alerts helped to establish the FTC, the state attorneys general, and NAAG as trusted sources of information about new forms of COVID-related consumer fraud.

Our anti-scam efforts have reinforced three principles fundamental to the FTC’s approach to education and outreach.

Our anti-scam efforts have reinforced three principles fundamental to the FTC’s approach to education and outreach.

- Talk to consumers in clear language that’s footnote-free and to the point. Just because we’re lawyers doesn’t mean we have to sound like it. There are helpful tools and programs to evaluate readability, but an effective nuts-and-bolts approach is to ask “How would I explain this to my dad (or aunt or nephew or neighbor)?” In addition, we took our own advice about language literally and reached out to underserved communities by publishing COVID-related alerts in Spanish, Chinese, Korean, Tagalog, and Vietnamese.

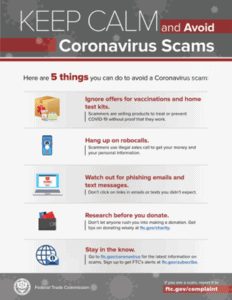

- Reinforce key messages in multiple media. Ad gurus call it multichannel marketing, but for the FTC and attorneys general, it’s a time-honored tactic for reaching the largest audience on a limited budget: using press releases, radio and TV interviews, blogs, videos, social media, webinars, audio clips, etc., to convey consistent anti-scam guidance through as many outlets as possible. One method that has proven particularly persuasive is the creation of infographics: fact-packed visuals that catch the eye and convey the essentials to consumers already at risk for information overload. The FTC also created a one-stop Coronavirus (COVID-19) Pandemic: FTC in Action page, organizing materials in separate portals for consumers, for businesses, and about law enforcement. In addition, thousands of people have subscribed to the FTC’s daily COVID updates, which keep them in the loop on enforcement actions, fraud facts, and other information with a coronavirus connection.

- Enlist others to help spread the word. Even as we’ve been working with state and national partners, we’ve also informally “deputized” individuals, consumer groups, and nonprofit organizations to distribute COVID-related information through their networks. Building on our ongoing Every Community initiative, we’ve reached out to ethnic media and contacted organizations representing the interests of lower-income consumers, veterans groups and military families, faith communities, college students, members of the LGBTQ+ community, senior centers, health professionals in rural and urban clinics, and others to ask for their help in alerting consumers as new forms of COVID-related fraud emerge. Across the country, people have answered the call by using FTC resources to help counter misinformation about “miracle” cures, vaccine availability, and financial assistance. Our materials are in the public domain, a fact that cuts through the red tape of attribution and authorization. In addition, we’ve designed our resources to make them easy to share in social media.

What we’ve learned so far. The long-standing plain-language and multimedia approach of the FTC, state attorneys general, and NAAG remains an effective strategy for communicating with consumers. We’ve also learned that millions of people nationally are eager to do their part to protect their communities from fraud. It helps to ask for their assistance directly and to let them know their efforts are appreciated.

Encourage consumers to report questionable conduct.

Even the most comprehensive monitoring program can’t spot every scam on every platform. But law enforcers have indispensable eyes and ears in the marketplace in the form of the consumers we’re dedicated to protect. For 15 years, the Consumer Sentinel Network has proven its worth as an investigative tool that gives local, state, and federal law enforcers access to millions of reports from consumers about suspected fraud or deceptive practices. Early in the pandemic, the FTC debuted its new ReportFraud.FTC.gov portal and worked with state partners to let consumers know that now more than ever, the FTC and the attorneys general need their reports about questionable COVID promotions.

Using that information, we published new FTC Data Spotlight articles, including Pandemic purchases lead to record reports of unreceived goods and Scams starting on social media proliferate in early 2020. As part of our Explore Data with the FTC initiative, we created an interactive Daily COVID-19 Complaint Data Dashboard to illustrate the breadth and depth of coronavirus-related scams. A generic comment like “Coronavirus fraud is a serious problem” isn’t likely to attract much attention. But saying “As of August 2021, we’ve received 585,707 COVID-related reports about scams that have inflicted $538 million in financial injury” packs a punch with consumers, public officials, and the media. The Dashboard also allows users to drill down to reported losses by state, by date, and by the form of fraud. With a few clicks, they can create national or state-specific visuals to embed in reports and presentations.

What we’ve learned so far. The pandemic has proven that empirical data about consumer fraud is a uniquely useful tool both in building law enforcement cases and designing educational campaigns. We’ll continue to ask consumers to report fraud, even if they didn’t personally experience financial loss. Through the newly-launched Community Advocate Center, we’ll work with legal services and other community organizations to encourage more reporting from underserved groups. And we’ll urge even more law enforcement and consumer protection agencies to become members of the Consumer Sentinel Network and input the reports they receive into the national database.

In appropriate circumstances, a forceful “Stop it now!” message to businesses can put an immediate halt to false claims.

In the first year of the pandemic, the FTC – on its own and in conjunction with the Food & Drug Administration – contacted more than 400 businesses, raising serious concerns about coronavirus prevention or treatment promises for their products or services. The cease-and-desist letters ended with eight unequivocal words: “You must immediately cease making all such claims.”

Why that unusual approach? Before effective treatments and vaccines became available – and even now – the consequences of a company’s bogus prevention promises can be quite literally a matter of life and death. Therefore, as state and federal law enforcers brought cases against businesses that attempt to profit from ineffective COVID cures, a corresponding priority was to get phony health claims off the market immediately. In the case of recipients of those letters, that meant within 48 hours. The good news is that the vast majority of businesses immediately took down their dubious representations.

Another example of forceful intervention was letters from the FTC and joint letters from the FTC and FCC to companies providing Voice over Internet Protocol (VoIP) services that were facilitating apparently fraudulent COVID-related robocalls. The joint letters gave those companies 48 hours to stop routing or transmitting harmful robocall traffic from entities involved in those campaigns. After that, the FCC would authorize other U.S. voice providers to block all calls from companies that received the letters.

What we’ve learned so far. In the specific circumstances of the pandemic, fewer questionable COVID treatments and cures on the market translates into more consumers implementing common-sense, science-based prevention strategies. We’ll never be able to calculate the number of lives that may have been saved by getting businesses to take down their unsupported claims immediately, but when media attention and industry word-of-mouth are factored in, we think the letters were a powerful tool for an unprecedented time.

Scammers have small businesses in their sights.

From the get-go, crooks have viewed smaller companies as targets for COVID-related fraud, including mutations on existing data theft and business-to-business (B2B) scams. Only a week after many companies and government agencies began the transition to a remote workplace, we revved up our outreach to small businesses with a March 25, 2020, Business Blog post, Seven Coronavirus scams targeting your business. In the months that followed, we published dozens of updates, warning them about imposter emails out to steal sensitive data, phony websites claiming to sell scarce personal protection equipment, and untruthful offers about government loans – most notably, false statements about the Paycheck Protection Program administered through the Small Business Administration.

As a result, the FTC and state attorneys general enhanced our outreach to small businesses struggling to stay afloat. We listened to their concerns, participated in local and state webinars on spotting B2B scams, and offered guidance on protecting their enterprises and their employees from jackals out to exploit COVID-disrupted workplaces. In addition, we updated the advice on the FTC’s IdentityTheft.gov website to offer concrete steps to fight back against a burgeoning form of fraud: unauthorized applications for unemployment insurance benefits.

What we’ve learned so far. We need to continue to communicate with small businesses about the threats posed by B2B scammers and to ensure that small businesses’ interests – and the interests of their employees – remain part of our 360˚ approach to fighting fraud.

Law enforcers need to use every tool at their disposal to protect consumers.

An FTC Staff Report, Protecting Consumers During the COVID-19 Pandemic: A Year in Review, summarizes the efforts we’ve taken to protect consumers from fraud and deception. But a few notable enforcement trends deserve special attention.

Many federal and state cases challenging COVID-related deception have alleged violations of established UDAP (unfair or deceptive acts or practices) statutes. For example, citing Section 5 of the FTC Act, the FTC sued a California-based marketer for making false or unsubstantiated COVID-19 prevention and treatment claims for Thrive, a concoction containing (among other things) Vitamin C, ginger, pomegranate, turmeric extract, cranberry juice extract, and carrots. The FTC also used its general UDAP authority in a law enforcement action against a Rhode Island investment outfit that bilked small companies by using the name “SBA Loan Program” and the URL SBALoanProgram.com to falsely claim it was a “direct lender for the PPP Program” with an affiliation with the SBA (Small Business Administration).

In addition to filing cases individually, the FTC and state attorneys general have used their UDAP authority to conduct a coordinated crackdown on deceptive money-making claims, some of which targeted consumers facing financial hardship due to the pandemic. As part of Operation Income Illusion, the FTC and 18 federal, state, and local law enforcement partners filed more than 50 actions against the operators of employment scams, pyramid schemes, and other promotions making misleading income promises.

In other cases, the FTC and the states have used conduct-specific rules or laws to attack COVID-related variations on illegal practices. For example, the FTC’s Mail, Internet, or Telephone Order Merchandise Rule – a consumer protection workhorse since 1975 – requires companies to have a reasonable basis for their shipment promises, to notify consumers of delays, and to give them the opportunity to cancel orders and get prompt refunds. The FTC has invoked the Rule in lawsuits against multiple companies that have made allegedly false claims about the availability and quick shipment of masks, sanitizers, and other personal protective equipment that consumers and small businesses couldn’t find on empty retailer shelves. In another ongoing action, a federal court issued a preliminary injunction against multiple marketers who impersonated the websites of Clorox and Lysol, accepted orders (and payment, of course) for cleansers and sanitizers, and then disappeared without shipping the products – only to reappear under different, but equally deceptive, URLs.

The FTC also has moved quickly to enforce a new statutory tool, the COVID-19 Consumer Protection Act. For the duration of the public health emergency, the law authorizes the FTC to seek financial remedies against companies that illegally market products or services related to “the treatment, cure, prevention, mitigation, or diagnosis of COVID-19” or “a government benefit related to COVID-19.” The FTC’s first actions under the law are pending in federal court.

What we’ve learned so far. The threat posed by COVID-related deception compels enforcers to consider every lawful measure at their disposal – general UDAP standards, older rules, and newer statutes – to vindicate the rights of consumers.

We’re better together.

It goes without saying – but we’ll say it anyway – that the current COVID crisis has strengthened the already solid partnerships among the FTC, state attorneys general, and NAAG. To the extent allowed by law, we have cooperated in bringing law enforcement actions. We’ve also followed pending actions closely to glean lessons from experienced state and federal consumer protection litigators. In addition, we’ve learned from each other about effective ways to address emerging forms of fraud. Many of those cooperative efforts remain behind the scenes, but one project bears particular mention: NAAG’s leadership with multiple attorneys general in responding to the spate of scams related to the availability of vaccines, including the sale of fake “CDC vaccination cards.” Joint NAAG-FTC graphics on vaccine-related scams continue to educate consumers in English and Spanish. And throughout the pandemic, the FTC, NAAG, and many attorney general offices have been in touch on outreach – often appearing together on radio media tours, hosting listening sessions about the financial impact of the pandemic on consumers and small businesses and speaking at ethnic media roundtables.

What we’ve learned so far. Federal and state consumer protection agencies carry out their shared mission more successfully when they work together. From the FTC’s perspective, we’re particularly grateful to NAAG for its role in fostering those robust partnerships.

Other articles in this edition include:

- Consumer Chief of the Month

- Attorney General Consumer Protection News: August 2021

- Federal Consumer Protection News: August 2021