State attorneys general play a critical role in enforcing state and federal consumer protection laws. While much of their activity is focused on enforcement within single jurisdictions, attorneys general frequently work collaboratively with one another and with federal partners on consumer protection efforts connected to widespread instances of business misconduct. These investigations are often resolved through multistate settlements that include both significant restitution for consumers and injunctive relief designed to change business behavior. NAAG is pleased to make available the Multistate Settlements Database, an online database of state attorney general multistate consumer protection settlements.

The modern history of multistate consumer protection actions began in the late 1970s with a multistate settlement with General Motors.1 Collaborative efforts expanded over the following several years when a coalition of attorneys general brought a series of consumer protection actions alleging widespread deceptive health and nutrition claims across the food industry. These efforts resulted in settlements with McDonalds, Sara Lee, Nabisco Brands, General Mills, Kellogg Company, and others.2 These actions, brought throughout the late 1980s and early 1990s, resulted in a series of single- and multi-state agreements in which industry members agreed to alter their advertising nationwide. The success of these efforts prompted state attorneys general to address consumer concerns in other industries as well. In 1987, NAAG created a task force to study marketing practices of the airline industry, ultimately promulgating “Guidelines for Air Travel Advertising” pertaining to deceptive advertising of airfare, frequent flyer programs, and travel packages.3 NAAG established a similar task force pertaining to consumer marketing in the car rental industry in 1989.4 The focus on these industries spurred additional multistate investigations, including allegations that consumers were charged for rental repairs that were the basis of a pair of settlements with car rental industry leaders Hertz and Avis Rent-a-Car in the last two years of the 1980s.5

By far the largest multistate effort was the tobacco litigation, which was resolved in 1998 through the Master Settlement Agreement between 46 states and the tobacco industry. This settlement was based upon a combination of consumer protection, antitrust, and Medicaid reimbursement legal theories, and ultimately led to more than $200 billion being paid by the industry to the states–payments that continue to this day. In addition to the monetary recoveries, the settlement contained many provisions aiming to change industry behavior. This included prohibitions on tobacco marketing to youth, bans on various forms of tobacco sponsorship of events, and an end to industry lobbying efforts opposing laws seeking to limit youth tobacco access and consumption.

Since the tobacco settlement, multistate consumer protection efforts have continued to grow and evolve. NAAG has set up working groups to address persistent problems affecting multiple jurisdictions, such as the Robocall Technologies Working Group established in 2017 to address unwanted calls to consumers, which remains among the most frequent consumer complaints to attorney general offices each year. Individual attorneys general have also set up units within their own offices to focus on specific issues, such as data privacy. Meanwhile, attorneys general work increasingly closely with enforcement partners at the federal level on consumer issues. Initiatives include the state-federal Task Force on Market Integrity and Consumer Fraud, which focuses on combatting deceptive marketing and addressing dangerous products, as well as enforcement sweeps with federal partners to crack down on scams and fraud.

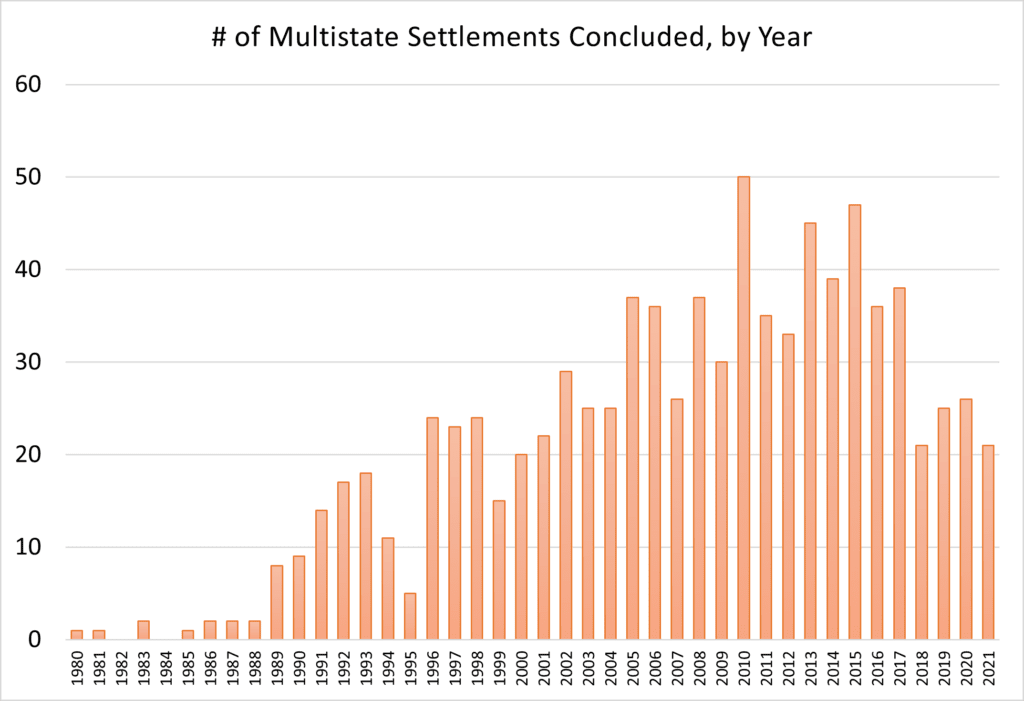

The number of multistate settlements concluded in a single year varies but has averaged between 25 to 35 in recent years, as illustrated below.

In addition to active investigations and litigation, attorneys general collaborate in other ways to protect consumer interests. Examples include multistate sign-on policy letters to industry leaders and policymakers, advocacy for regulatory and legislative reform both within their states and with Congress and federal agencies, and multistate amicus briefs urging expansion of state and federal authority to investigate corporate wrongdoing involving consumers.

The scope of multistate consumer protection efforts has expanded from comparatively modest efforts to combat deceptive food labelling to much broader nationwide efforts to tackle a range of consumer-focused issues. The following briefly highlights a few prominent areas of attorney general enforcement in recent years.

Data Privacy and Information

Protecting consumer data has been a focus of attorney general multistate efforts. Recent efforts include addressing major data breaches affecting consumers nationwide. For example, after consumer reporting agency Equifax announced a massive data breach in 2017 affecting nearly 150 million consumers, a multistate coalition of attorneys general launched an investigation into Equifax’s data security measures. The investigation found that Equifax failed to institute adequate security measures and knew about but failed to correct a critical vulnerability in its software, all of which contributed to this significant release of consumer information.

Following the investigation, Equifax and fifty attorneys general agreed to a settlement with significant consumer compensation including a $425 million consumer restitution fund as well as an additional $175 million to the states. The settlement also required meaningful injunctive relief, including requiring Equifax to make significant changes nationwide in its procedures protecting consumer data, including requirements for regular security monitoring, reorganization of its data security team, and adoption of new internal policies to ensure critical security updates occur.

Attorneys general have worked together to address many other major data breaches affecting consumers nationwide, including with technology companies Uber and Google, retailers Target and Home Depot, and health insurance company Anthem. Each of these settlements required that the corporations create and maintain comprehensive information security programs moving forward, demonstrating that state attorneys general are not only interested in obtaining restitution for consumers but also seeking to prevent significant data breaches from occurring again in the future.

Lending Practices

Attorneys General’s focus on consumer lending practices stretches back two decades, starting with a landmark settlement with mortgage lender Household Finance in 2002 pertaining to unfair and deceptive lending practices in the subprime lending market. That nearly $500 million settlement helped set new standards in the lending industry by limiting prepayment penalties on home loans, reducing origination fees, improving disclosures to consumers, and imposing numerous additional requirements pertaining to subprime mortgage lending. Following the financial crisis in the first decade of the 21st century, attorneys general followed up with an even larger $25 billion state-federal settlement with the five largest mortgage servicers seeking to hold the industry accountable for deceptive lending practices contributing to the financial crisis. Among other requirements, the settlement addressed robo-signing abuses, provided strict oversight of foreclosure processing, and established an independent monitor to oversee the dozens of consumer protection provisions included in the agreement.

More recently, state attorneys general have continued their work to combat abusive mortgage industry practices by investigating alleged over-charging, unauthorized enrollment in banking services, excessive mortgage servicing fees, and more. Multistate efforts have included investigating predatory lending in other industries outside of housing. A recent 2020 settlement with Santander Consumer USA, the nation’s largest auto financing company, concluded an investigation of the company’s predatory auto loans to low-income borrowers. In addition to significant debt cancellation, the settlement required a fundamental restructuring of the company’s business model, in part by requiring Santander to consider a consumer’s ability to pay when making loans.

Internet Safety

Through multistate cooperation, state attorneys general have sought ways to make the Internet safer by prompting tech industry leaders to do more for child safety and to adopt measures to prevent crimes. A recent multistate letter to Facebook called upon the social media giant to abandon efforts to develop the child-focused Instagram Kids platform, in light of concerns about the physical and social harms social media can have on children. These harms include cyberbullying, access to inappropriate internet content, deceptive advertising, and harmful psychological effects on specific groups including young girls. Following the bipartisan attorney general letter, along with efforts by federal partners, Facebook recently abandoned its plan to roll out the app to children 13 and younger.

Attorneys general have also undertaken a multistate investigation of leading Internet advertising sites that were allegedly facilitating illegal prostitution and sex trafficking. The multistate effort led to Craigslist closing its “adult services” section and prompted congressional and U.S. Department of Justice investigations of Backpage.com’s role as a leading facilitator of illegal activity, much of it involving children. While these efforts were based largely on investigating crimes rather than violations of consumer protection statutes, they serve as a reminder that multistate efforts to protect the public span a range of important issues and can have a national impact.

Robocalls/Do-Not-Call

Robocalls and do-not-call violations top consumer complaint lists for many attorney general offices as well as the U.S. Federal Trade Commission (FTC). Several multistate efforts to prevent calls from scammers and calls about unwanted products and services have been coordinated through the previously mentioned NAAG Robocall Technologies Working Group, established in 2017. In August 2019, fifty-one attorneys general and twelve major voice service providers signed a “Statement of Principles” describing ways in which all parties would work together to tackle the robocall problem. The statement included eight principles under which the telecom industry would implement new call blocking technologies, cooperate in investigations, and cooperate with state attorneys general on recognized scams and trends in illegal robocalling.

In addition to that cooperation with leading industry members, state attorneys general have led efforts to spur legislative and regulatory changes to address robocalling. This includes a 54-state letter to Congress urging passage of the TRACED Act that would address illegal scam calls and multistate comments to the FTC urging a faster timeline for implementation of new caller identification authentication and

* * *

These are just a few of the recent areas of attorney general focus on multistate consumer protection efforts. You can explore more by accessing NAAG’s searchable Multistate Settlement Database.

- Lawrence Fellows, “Suit Puts Consumers in the Driver’s Seat,” New York Times, Jan. 8, 1978, at CN1. [↩]

- Michele M. Bradley, The States’ Role in Regulating Food Labeling and Advertising: The Effect of the Nutrition Labeling and Education Act of 1990,” Food and Drug Law Journal, 49(4) (1994): 649-674; Marian Burros, “Eating Well,” New York Times, October 11, 1989; Paul Farhi, “Campbell to Pay Nine States $315,000 to Settle Dispute on Soup Ad Claims, Washington Post, May 11, 1989 [↩]

- Guidelines for Air Travel Advertising, 53 Antitrust & Trade Reg. Rep. (BNA) No. 1345, at S-1 (Dec. 17, 1987). [↩]

- Report and Recommended Guidelines of NAAG’s Task Force on the Car Rental Industry, 55 Antitrust & Trade Reg. Rep. (BNA) No 1395, at 1020 (Dec. 15, 1988). [↩]

- Michael Decourcy Hinds, “States Assuming a New Role in Consumer Issues,” New York Times, Feb. 8, 1988. [↩]